What are the TAX benefits from Private Retirement Scheme (PRS)?

According to Securities Commission of Malaysia, tax incentives are provided to both employers and individuals for the first 10 years from assessment year 2012; in addition to the tax deduction permitted for EPF contributions:

|

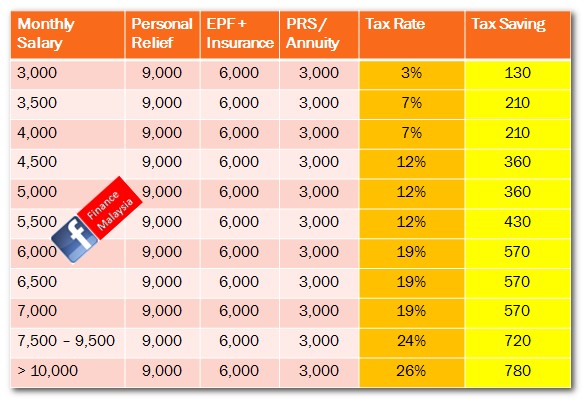

| Amount of Tax Savings by individuals for PRS contributions |

For Individual:

Tax relief of up to RM3,000 per year will be given for contributions made within that year. This is on top of existing tax relief already enjoyed by taxpayers. How much can you save from tax? Let's look at the table above which illustrates the amount of tax saving an individual get after personal tax relief and RM6,000 EPF + Life Insurance tax relief. Assuming maximum RM3,000 PRS relief, the amount of tax saving depends on your level of income. For high tax bracket individual, you can save up to RM780 annually!!!

For Employer:

Tax deduction on contributions to PRS made on behalf of their employees above the statutory rate of up to 19% of employees' remuneration was granted. Example, if an employer already making 12% EPF contributions to his employees, the employer may choose to reward their employees by contributing into employees PRS account for up to another 7%.

Vesting Schedule to Retain Employees?

Yes, employer can use PRS as a tool to retain employees by adding a "vesting schedule" clause. Currently, there are a few available vesting methods: by length of service, job rank, or by age. Unlike EPF, if an employee leaves before vesting, the employer can access to the un-vested portion of contribution already made. Likewise, for EPF, employee take the full amount when they left. With PRS vesting schedule, employee may think twice before switching jobs.

In conclusion, there are tax incentives for every tax payer, employee or employer. Ultimately, enough retirement funds was the key objective of PRS. On top of that, a tax exemption is also provided on income received by the funds under the PRS.

This is a guest post by Alex Yeoh in the series of Private Retirement Scheme. For more PRS info, you may contact Alex Yeoh (alexyeoh@vka.com.my), a licensed financial planner, whom can distributes products from multiple PRS providers. Thank you.

Comments

Post a Comment